Institutional investors

From complex fund reports to actionable portfolio intelligence.

For institutional fund investors, true portfolio insight is buried in thousands of documents. We automate the extraction of critical data from quarterly reports, capital account statements and financials. We turn your static documents into a dynamic data asset, empowering you to analyse risk, measure performance and report with confidence. The essential platform for fund-of-funds, secondaries investors and family offices.

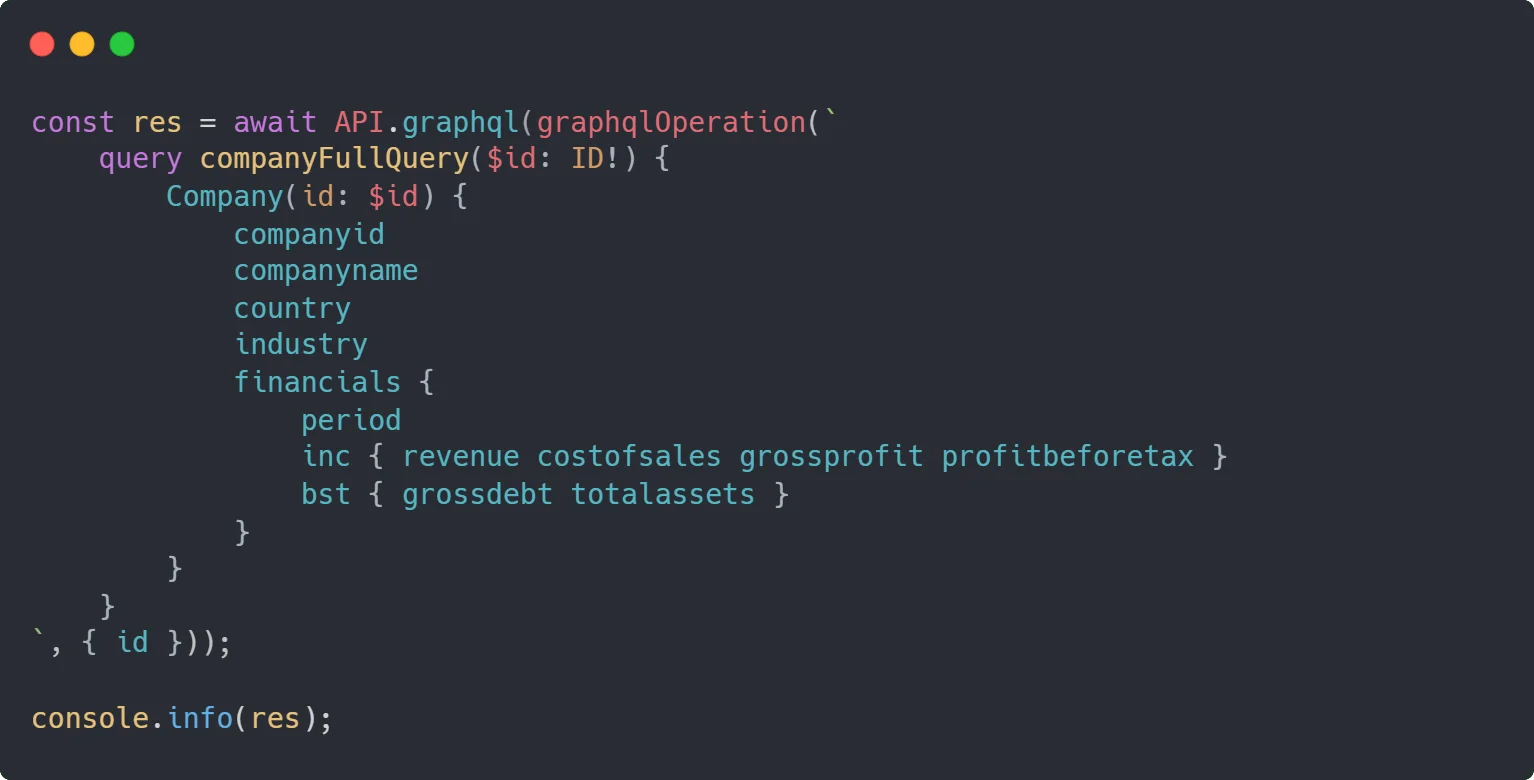

Automate data extraction and eliminate human error.

Scribe ingests your fund documentation, from PDFs of quarterly statements to capital account statements, extracting financial data with machine precision. Eliminate costs, delays, and errors associated with manual data entry and give your team back its most valuable asset: time.

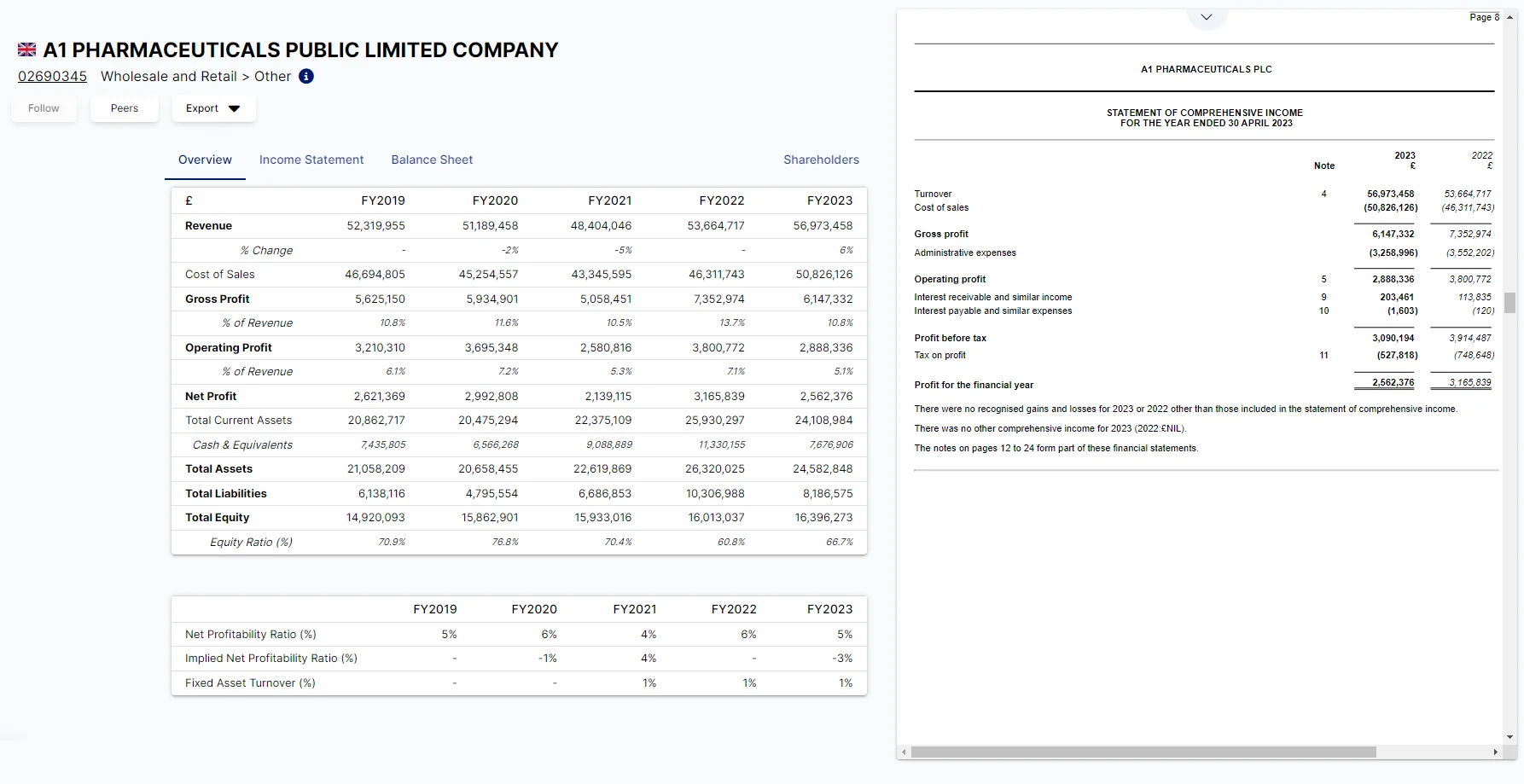

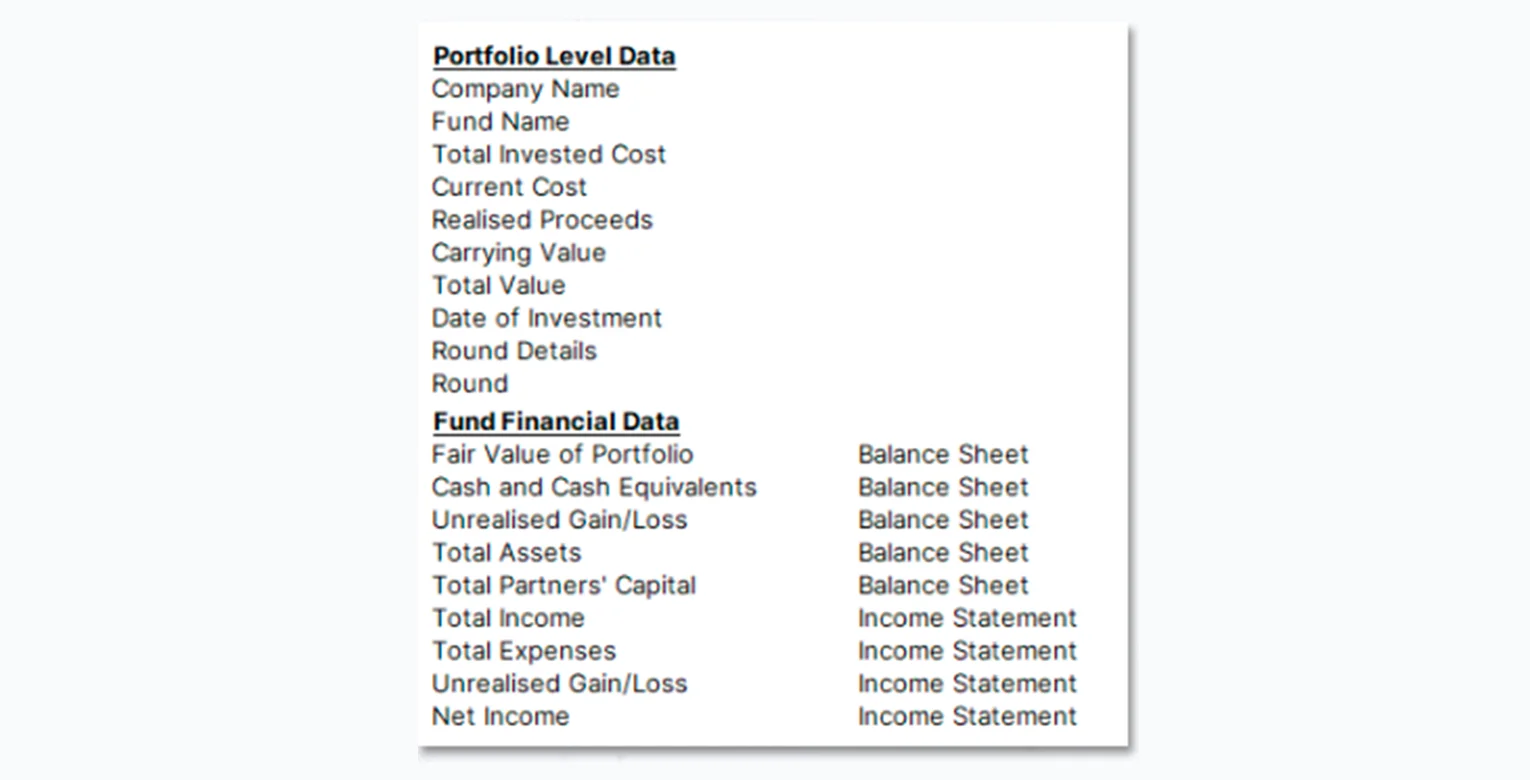

Achieve true look-through portfolio analysis.

Move beyond fund-level metrics. We provide the data necessary to analyse the performance of the underlying private companies you are exposed to. Track Fair Value, Total Cost and more across every investment to understand exposure, identify outliers and manage risk.

Turn your deal-flow into a proprietary asset.

Every fund pitch deck is a piece of market intelligence. We provide a solution to the challenge of inbound deal flow. Scribe reads fund marketing documents and extracts the essential data needed for initial evaluation. The result is a structured pipeline allowing you to compare and prioritise.